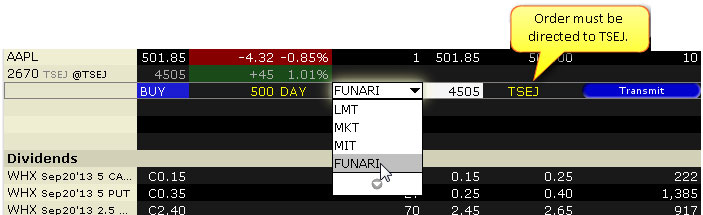

Funari Orders

A Funari order is submitted as a limit order at the user-specified limit price, with any unfilled quantity resubmitted as a Market-On-Close order at the end of the trading session. Market-On-Close orders execute as close to the closing price as possible.

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Stocks | Non-US Products | Directed | Order Type | ||||

| Direct routed to Tokyo Stock Exchange (TSEJ) | |||||||

| Open Users' Guide | |||||||

Example

Disclosure

IB may simulate market orders on exchanges. For details, see market order handling using simulated orders.