T+0 Early Stock Settlement

A traditional disadvantage of buy-writes has been the possibility of triggering unwanted capital gains tax on previously purchased stock shares in the event the options are assigned. T+0 stock settlement allows you to purchase replacement shares to use against an assignment and potentially preclude capital gains and a higher tax liability. This strategy may be appropriate if you wish to continue to hold shares in your account that were subject to the option assignment.

- Tag US stock shares for early settlement, allowing you to purchase shares after the assignment notice and still have these new shares in your account before the option assignment settles.

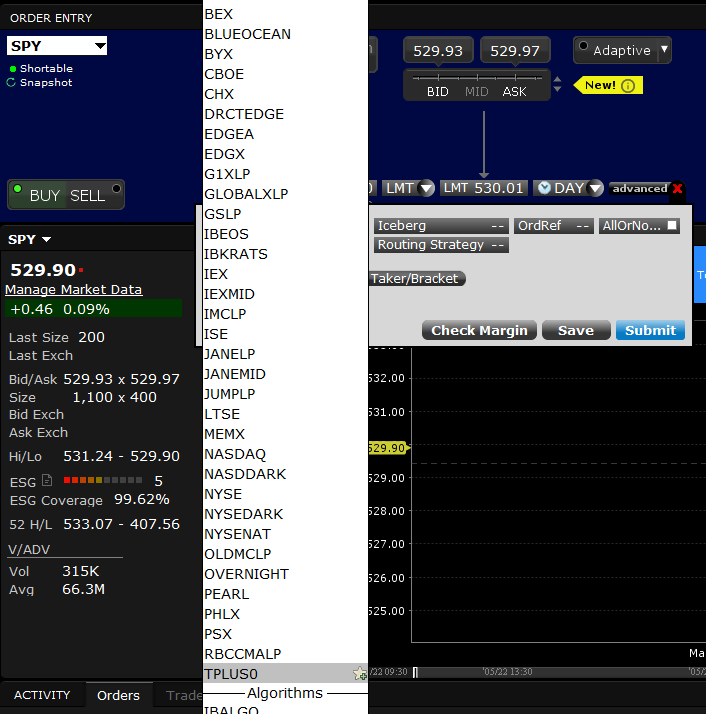

- It's easy to tag stocks for early settlement. Simply select TPLUS0 as the order destination before you submit the stock buy order.

Important Information About T+0 Settlement:

- T+0 Settlement is only available on certain equity securities at our discretion, and these securities may change from time to time. The executing broker reserves the right not to offer T+0 Settlement at any time and for any reason.

- T+0 Settlement trades generally will be executed against an affiliate of the executing broker, which may profit or lose in connection with the transaction.

- T+0 Settlement trades may not be available for particular securities on a particular date or time. For example, the executing broker may not be able to find a counterparty who is willing or able to sell shares for T+0 Settlement.

- You may pay a different or worse price for shares you purchase for T+0 Settlement (i.e., for non-regular way settlement you may pay more than the best price offered in the market for regular way settlement). In addition, certain price protection rules that apply to regular way settlement do not apply to T+0 trades.

- T+0 trades are conditioned on your order satisfying credit, risk and other applicable regulatory requirements.

- Use of T+0 Settlement may be part of a strategy to minimize tax exposure. We do not offer tax advice. You and your tax advisor should evaluate whether use of T+0 Settlement will result in the desired tax consequence.

- The TPLUS0 order destination is not offered during the period which includes the five (5) business days prior through the five (5) business days subsequent to the effective date of any corporate action.

- Before you can select the TPLUS0 destination, you must enable the trading permission United States (T+0 Settlement Program) in Client Portal*.